All around the world, the insurance industry faces an evolving nature of risk and disruption. From political instability to the long-term challenges of climate change, insurance providers must continuously update their knowledge bases to engage with evolving sources of risk.

Additionally, the rise of disruptive technologies and changing regulations in key markets are challenging operational structures in an industry where success has traditionally emphasised stability and risk aversion. Altogether, insurance companies are receiving prompts to embrace or compete with a shifting field of opportunities and challenges.

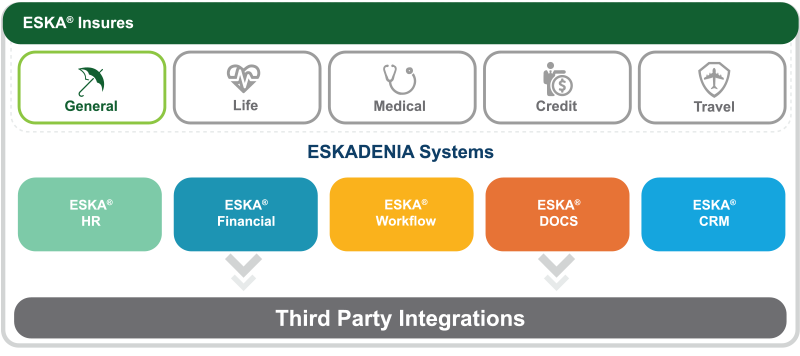

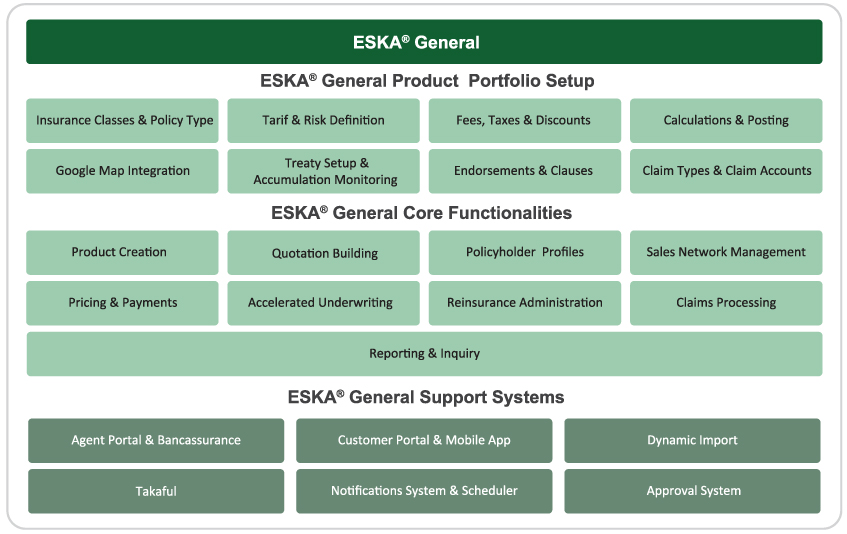

ESKA® General is a powerful digital system geared to strengthen every dimension of general insurance. Providing class-specific functions for insurance classes spanning motor, property, general accident, cargo & hull, engineering and aviation, ESKA General empowers you to craft and continuously refine a robust insurance enterprise for the twenty-first century.

ESKA General provides adaptable configurations and mobile features, giving you a flexible platform to convert innovative ideas into tangible fixtures in your operation. Replete with accelerated underwriting, risk assessment, reinsurance management and sales organization, ESKA General empowers you to deliver competitive products and drive reliable growth in an industry of evolving risks.

![SafeValue must use [property]=binding: Resources/2/general-insurance-General-Brief-1.jpg (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/general-insurance-General-Brief-1.jpg)

![SafeValue must use [property]=binding: Resources/2/general-insurance-takaful.jpg (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/general-insurance-takaful.jpg)

![SafeValue must use [property]=binding: Resources/2/general-insurance-Quotation-Builder.jpg (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/general-insurance-Quotation-Builder.jpg)

![SafeValue must use [property]=binding: Resources/2/general-insurance-advanced-underwriting.jpg (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/general-insurance-advanced-underwriting.jpg)