Supporting a changing brokerage industry

The brokers and exchanges industry is experiencing a sense of urgency. The growth of risks in today’s society is pushing more companies for insurance services, thus the rise of insurance brokerage services. This expansion has led to many innovative solutions to ensure powerful yet efficient brokerage and trading services.

This brings us to the utilization of technology for brokerage industries. With many leading insurance companies shifting to technological adoption, brokerage companies also need to cater to the growing changes of insurance; which brings us to an adaptive system that will integrate with core insurance companies.

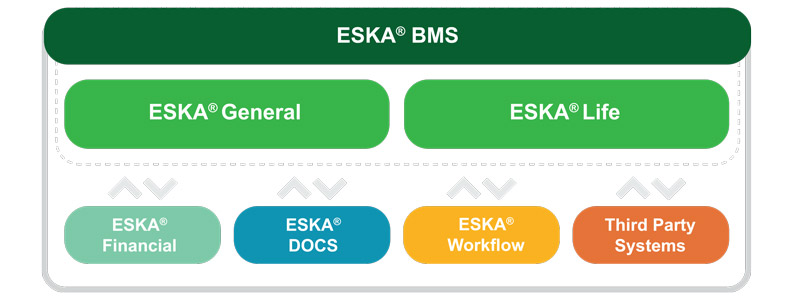

ESKA® BMS is our broker management system made to assist the day-to-day activities of brokers.

Acting as a mediator between clients and insurance companies, ESKA BMS functions to ease process and increase productivity. Covering General, Life and Medical insurance, this convenient system covers a number of sectors and incidents for your insurance needs.

This may include Property/Fire, General Accidents, Engineering, Marine, Motor, Medical and Group Life lines. ESKA BMS acts to ease the process of attending to insurance companies and the insured. By creating an automated process, turn your brokerage workflow into a direct and secure process.

ESKA BMS covers a range of functionalities related to:

Brokerage operation taken care of

User Profile & Dashboard

Integrate with all aspects of the company

![SafeValue must use [property]=binding: Resources/2/insurance-bms-11.jpg (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/insurance-bms-11.jpg)

![SafeValue must use [property]=binding: Resources/2/insurance-bms-12.jpg (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/insurance-bms-12.jpg)

![SafeValue must use [property]=binding: Resources/2/insurance-bms-13.jpg (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/insurance-bms-13.jpg)

![SafeValue must use [property]=binding: Resources/2/insurance-bms-14.jpg (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/insurance-bms-14.jpg)

![SafeValue must use [property]=binding: Resources/2/insurance-bms-15.jpg (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/insurance-bms-15.jpg)

![SafeValue must use [property]=binding: Resources/2/insurance-carenet-15_(1).jpg (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/insurance-carenet-15_(1).jpg)

![SafeValue must use [property]=binding: Resources/2/insurance-bms-14_(1).jpg (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/insurance-bms-14_(1).jpg)

![SafeValue must use [property]=binding: Resources/2/insurance-bms-18.jpg (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/insurance-bms-18.jpg)